- Joined

- Oct 3, 2007

- Messages

- 14,816

New Vehicle Excise Duty (VED) bands are to be introduced, with revenues eventually going towards a new Roads Fund, the chancellor has announced.

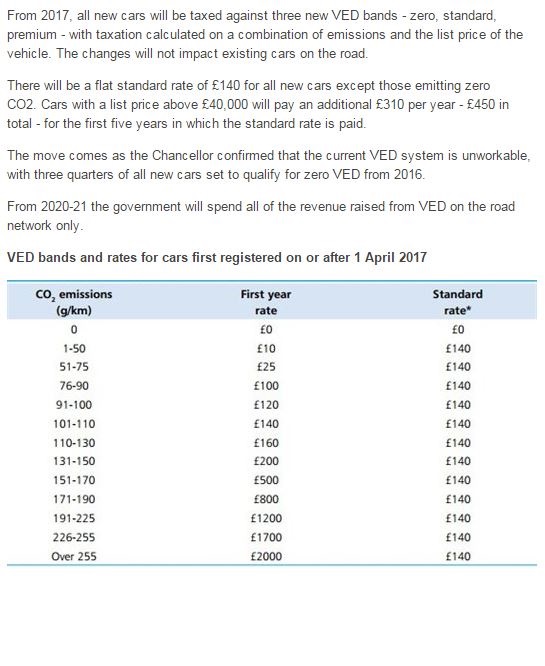

For cars registered after 1 April 2017, VED will be transformed into three bands - zero, standard and premium.

George Osborne said the "standard" charge of £140 would cover 95% of all cars. Revenues will be paid into the Roads Fund from 2020-21.

The chancellor also said that fuel duty would remain frozen this year.

Mr Osborne said: "There will be no change to VED for existing cars - no one will pay more in tax than they do today for the car they already own."

He added that the £140 rate was less than the average £166 that motorists pay at present.

However, the new rates will not apply in the first year after registration. There will be special first year rates linked to a car's carbon emissions.

Steve Gooding, director of the RAC Foundation, said: "Costs for many drivers will rise, but two things help offset the financial pain.

"One is that new car prices have dropped in real terms over many years and the other is that money raised from VED will be ring-fenced for road investment, something not seen since the 1930s."

http://www.bbc.co.uk/news/business-33447106" onclick="window.open(this.href);return false;